Menu

Stewardship is the responsible allocation, management and oversight of capital to create long-term value for clients and beneficiaries leading to sustainable benefits for the economy, the environment and society.

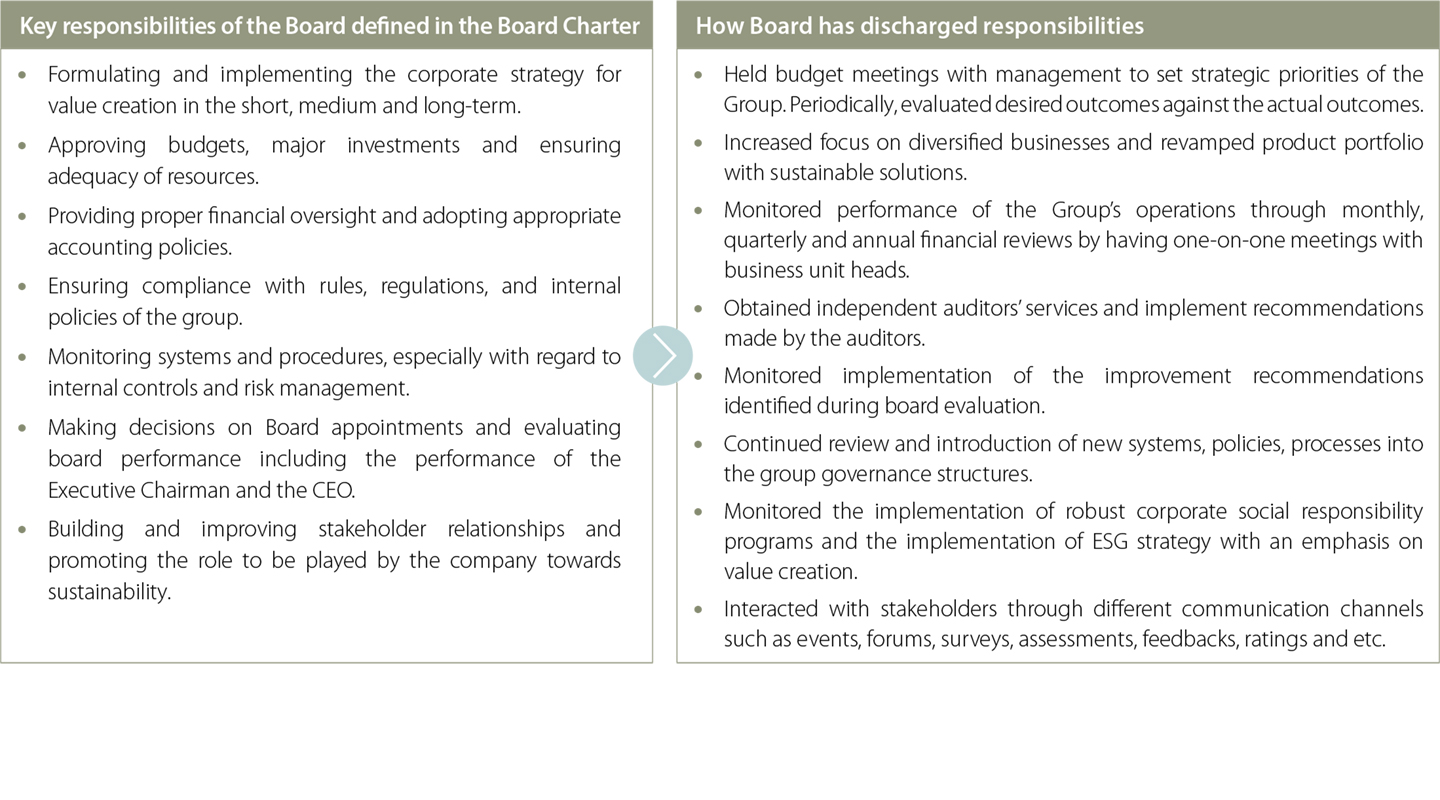

Setting the Strategic Direction

The Board of Directors as part of its stewardship role is accountable to navigate the organisation through the economic challenges that lie ahead. While undertaking a digital transformation which is one of the largest investments of the Group, the Board directed the Group to a brand-new set of priorities to “Reimagine” its strategy to overcome anticipated challenges from the economic crisis. The focus of this strategy will be on achieving a balanced product portfolio with less dependency on economic volatilities, expanding the market share of existing products, and re-engineering business processes for greater efficiencies and synergies.